善理财者,不加赋而国用足 。

王安石

存款

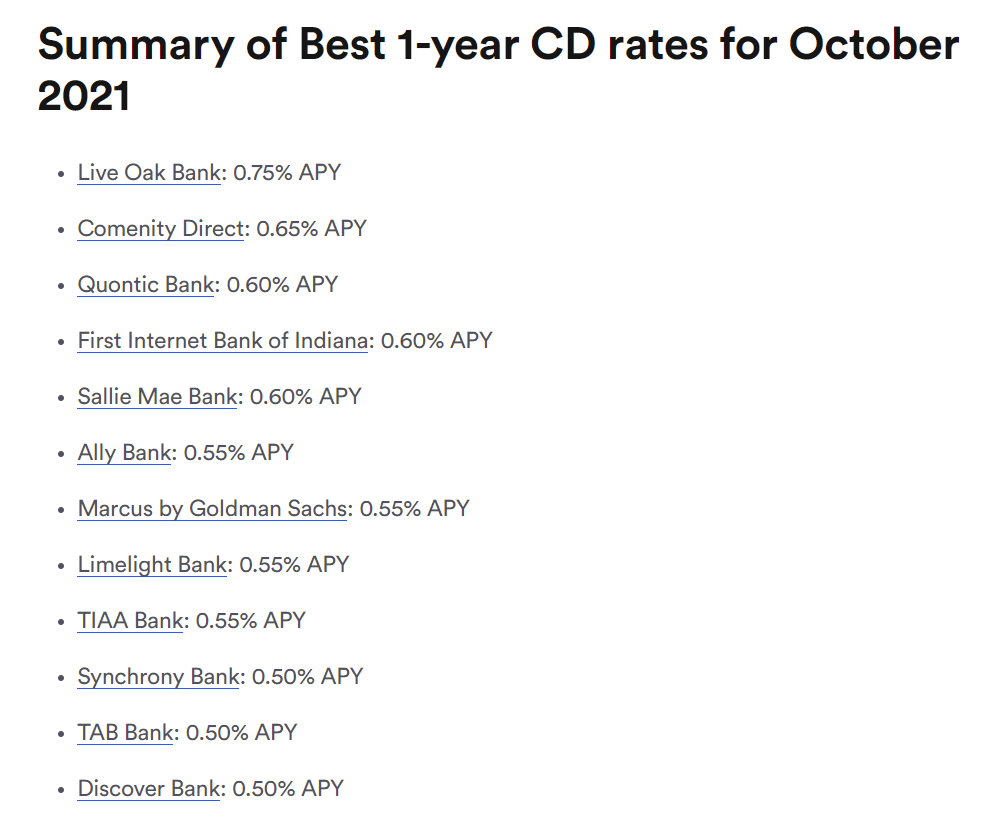

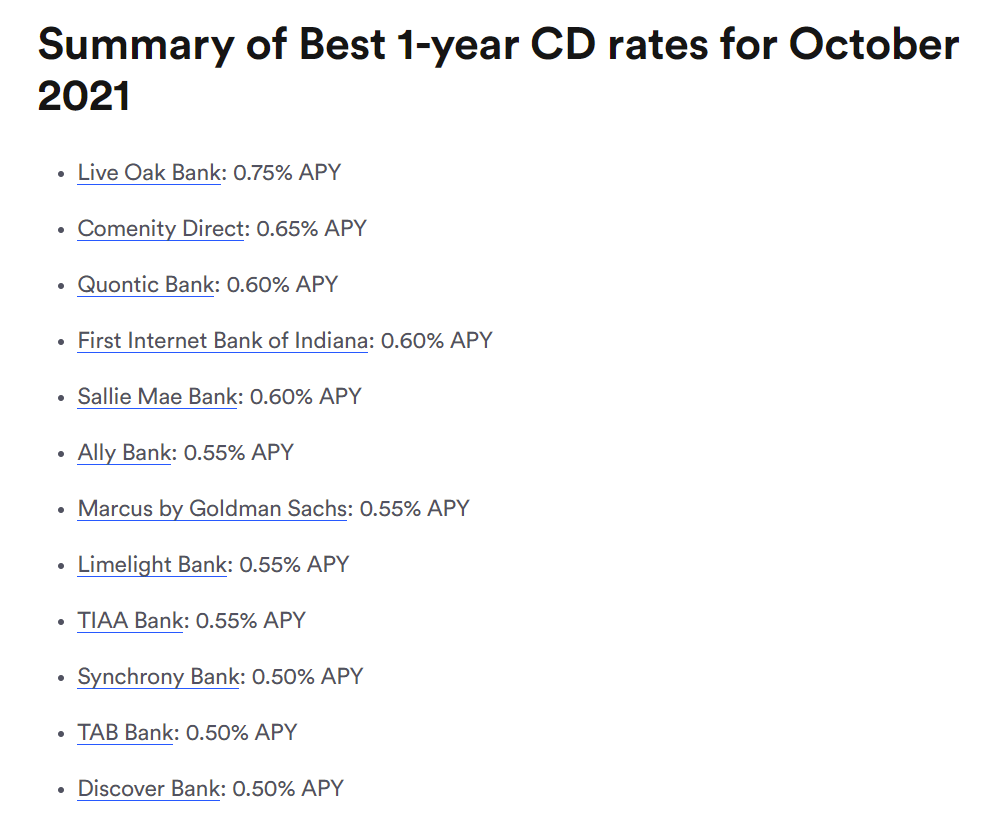

投资理财的目的是保值和增值。每个人风险承受能力和回报期待不一样,因此会选择不同的理财方式。存钱是最基本也是最简单的理财方式。随存随取是活期,固定存一段时间就是定期,因为时长和灵活度不一样,利息也不一样。2021年,中国活期存款利率在0.3%左右,不同冻结期的定期可能会有1%到4%不等的利息。美国这边活期存款是没有利率的。即使是定期,这边称为CD(certificate of deposit) 大额存单,利率一般也就在0.5% – 1%之间。下图是10月份美国不同银行一年定期的年利率。

美国人不爱存钱,他们也没钱可以存。生活在一个鼓励消费的国家,一般人几乎都是月光族甚至要刷信用卡。美国人不爱存钱这件事可能也和美国社会机制相关。美国有很多种税前投资计划,允许美国人将税前收入存入特定账户,用于特定的开支。因为美国工资税是很可观的一部分,因此可以进行税前投资很有吸引力,这些税前计划包括401K账户,IRA(Individual Retirement Account), FSA(Flexible Spending Account), HSA(Health Saving Account) 等,基本都由雇主和公司提供(点这儿具体了解美国税前计划)。以401K计划为例,这项计划允许员工通过公司设定的401K账户将一部分税前工资存入账户。另外,很多公司还有给员工401K补贴的福利。比如员工把工资税前的3%存入401K账户,公司会出资给员工多存2%。因此,投资这些账户比将税后工资存入银行更有吸引力。不过401计划每年有投资上限。2021年401K的投资上限是$19,500。 50岁以上的员工可以多追加$6,500。税前账户里的钱,如果不想仅仅放在那,可以选择投资基金和股票。我个人也是因为401K账户的资金配置开始接触美国基金的。

基金

美国基金分公募基金和私募基金。公募基金又分成共同基金(mutual fund),ETF(exchange-trade fund),封闭式基金(closed-end fund),单位投资信托(unit investment trust)。最常见的是共同基金和ETF。共同基金类似于国内的普通开放式基金,ETF是开放式交易所指数基金,类似于股票。两者最大的区别在于,共同基金是主动性管理基金,基金经理通过调整基金不同的资产组成,试图击败市场表现帮投资者获利,一天只在市场闭市之后交易一次;而ETF大多是被动式管理的,通过追踪特定市场指数,可以在股票交易时段随时买卖。关于主动型基金和被动型基金的优劣,巴菲特有过一个10年赌局。巴菲特投资标普500指数基金,而他的对手则采用主动型投资策略,聘请数百名投资专家来进行投资管理。后来正如巴菲特坚信的那样,即使遭遇2008年美国次贷危机,标普500指数基金也还是打败了对手的主动型投资,赢了这场赌局。当然,美国肯定有投资能力强的基金管理人,比如巴菲特那样的。但一般人很难发现这样的管理人,或者够不上那类基金的投资门槛。因此,如果不想花太多时间研究,ETF是个很好的选择。费率相对低,省时省力且回报率高。当然,这在美国基金市场比较适用。国内基金市场单个基金表现好于大盘指数的情况还挺多,主要是因为国内散户较多,市场不够成熟稳定,因此指数基金并没有优势。

国内基金购买的平台很多,理财app比如同花顺,雪球,富途等都可以买入。支付宝和微信钱包也可以购买基金。当然也可以去特定基金发行公司的官方app购买。各平台的费用都差不多。美国基金的购买平台主要有vanguard,fidelity,ameritrade等。相对来说,基金投资是比较容易上手的中高收益理财手段。定投是投资基金较好的方式。如果你准备长期投资基金, 比如3到5年, 尽早进入市场并保持定投是取得不错收益的方法。如果相对短期,比如一两年,尽量在基金回调的时候买入,而不是在山顶高点的时候。之前我觉得基金的买入点无所谓,但是我目前有只基金持有期超过一年,也在低点补仓了,但收益还是负的。因为这只基金从高点回调太多了。国内基金更容易出现这种情况,因为之前说国内基金表现优于指数的可能性很大,那同样的回调的幅度也会很大。对于这种类型的基金,选择好的买入点比较重要。但如果是长期投资,可以忽略这些变量,时间会淡化买入点的影响,早点开始定投比较重要。

相对于买点来说,什么时候卖以及如何卖是更值得讨论的一件事。我个人觉得,如果投资的钱是不急用的,一直搁在基金里也没有问题。因为卖出之后,如果没有更好的标的,那钱还不如在市场里面继续流动。当然,适当止盈也是挺好的方法。如果你觉得基金已经翻了一倍,或者有了百分之七八十的收益很满意了。卖掉一部分,然后等回调一些再买进也不错。但是,等待回调这件事情,其实很不靠谱,因为没有人可以预测市场,也不能择时买卖, 所以老老实实和市场一起成长是正确的做法。如果止盈之后正好碰到回调,那是非常幸运的。大多数情况是,因为卖出反而错过了一些基金的增长期。

另外,我想重点聊一下美国共同基金基于不同成本基准的不同卖出方式。因为美国资本收益税高,长期收益和短期收益在税率上差别也比较大。一般来说,持有一年以上的基金被称为长期投资。美国的基金在卖出的时候,可以根据不同需求选择不同的成本基准来卖出。

美国共同基金目前主要有这几种成本基准的卖出方式,

- FIFO (First in first out) 先买进的先卖出

- LIFO (Last in first out) 后买进的先卖出

- Average Costing 平均成本卖出

- HIFO (highest in, first out) 高成本的先卖出

- LIFO (Lowest in first out) 低成本的先卖出

倘若投资者想要卖出100股基金,为了尽可能减少资本收益税,它可以选择最高成本的100股先出,这样收益少,交的税也少。同时他可以选择FIFO先买进的那100股先卖出,因为长期投资资本收益税比短期低很多,甚至可以到免税。所以如果想要最大程度的利用长期收益税率低的优势,可以卖出持有一年以上的份额。如果选择平均成本卖出,会先卖出最早买入的一批。国内基金卖出就相对简单一些,卖出费率高低也和持有时长挂钩,但费率差别相对小。比如持有时长为7天以内费率为1.5%,一年以内是0.5%。

账户配置

不同的投资者年龄,经济基础和风险承受能力不同,从而资产配置也不一样。复利效应大家应该知道。拥有时间资本在理财中是很大的优势。如果你有1万块,之后每个月继续投入1000,假设每年的投资回报比是10%,那么30年以后,光这部分投资的资产就会达到215万。做时间的朋友,慢慢变富是很好的一件事情。如果你还年轻,有资本承受市场的波动,你的资产配置可以相对激进一点。比如8成股票型资产(包括股票型基金),2成的存款和债券。如果你已经中年,可以相对保守地配置6成股票型资产。退休之后,可以选择更保守的基金和长期存款类理财产品。每过几年,就应该调整一下自己的资产配置。但不管什么年纪,投资的钱最好都是闲钱,是把一年生活所需放到一边之后多出来的资金。不然急用被迫需要取出投资的钱会很不划算。

免责声明:本文只是一般性介绍,不构成任何投资建议。理财有风险,投资需谨慎。

Saving

Financing is for the preservation and increase of capital. Every one has different risk tolerance and return objectives, thus each will resort to different investment methods and strategies. Saving is the basic and easiest way of financing. Regular saving and fixed-term saving have different flexibility and maturity periods, generating different interest rates. In 2021, China’s regular bank saving interest rate is about 0.3%, and the fixed-term saving interest rates vary from 1% to 4%; In the U.S., there is usually no interest rate on regular saving. As for fixed-term saving, which is also called CD (certificate of deposit), the interest rate is generally between 0.5%-1%. The chart below is the U.S. APY(annual percentage yield) of CD in October 2021.

Americans don’t save money. Living in a country that encourages advance consumption, lots of people actually live paycheck to paycheck, or even on credit cards. However, they can choose multiple pre-tax accounts to invest in. American income tax consists a considerable part of their income, so pre-tax investment is very alluring. Pre-tax accounts include 401K account, IRA, FSA, HSA etc. Most of them are provided through the employer. Take 401k account as an example. It allows employees invest pre-tax income. Some companies even match employees’ contribution. For instance, if employee contribute 3% per paycheck, the company might match 2%. That makes a total 5%. However, there is a contribution limit each year. The limit for year 2021 is $19,500. Those above 50 years old can make catch-up contribution up to $6,500. If employees don’t want to just let the money sit there, they can invest the money in funds or stocks offered. That is how I first got in touch with mutual funds.

FunDS

U.S. funds are also divided into public funds and private funds. Public funds include mutual funds, exchange trade fund, closed-end fund, and unit investment trust, among which mutual funds and ETF are most heard of and familiar to us. Mutual funds are actively managed funds. Fund managers try to beat the market performance by adjusting asset composition of the fund. They are similar to open-ended funds in China. They can only be traded once a day after the market closes; ETFs are mostly passively managed by tracking a specific market index. Investors can buy and sell at any time during stock trading hours. Regarding the performance of mutual funds and ETF, Warren Buffet placed a million-dollar bet with hedge fund industry before. He won. His conclusion is that, including the fees, costs and expenses, S&P 500 index fund will outperform a hand-picked portfolio over 10 years. Passively managed funds will perform better than actively managed funds. Of course there are great fund managers in the U.S., like warren Buffett. But it’s either hard to identify those managers or the fund enrollment is above regular investors. If you do not want to invest much time, buying passively managed index funds is a better option. It has lower fees and competitive return rates. However, this might not be true in Chinese funds market. Retail traders are much more active in Chinese market, which brings more volatility to stocks and funds, and thus it is quite often to see better performing mutual funds than index funds.

In China, funds can be easily purchased on platforms such as Tong Hua Shun, Snowball, and Futu. You can also get it through Alipay and Wechat finance applications, and of course on funds’ official websites. Fees are mostly the same across all venues. In the U.S., most investments accounts, like Vanguard, Fidelity and Ameritrade, offer funds. Comparatively speaking, funds are easier investment with decent return rates. Funds investment should be long-term. Automatic investments is the best way. Start investing early and turn it on autopilot. If it is only for short term, it will be better to find a relatively low entry point, rather than to buy it at the highest. I used to think the entry point for funds does not matter that much. But this may not be true for Chinese funds since they can be very volatile. It goes up fast and takes a long time to correct if it plunges. However, if you plan to hold it for very long, that doesn’t matter anymore either. Buying early would be the most important strategy.

Besides when to buy, when and how to sell is also critical. The ideal way would be holding it long term. However, if a better investment ever appears, it is ok to take profits and divert the money. It is also understandable to sell high to secure the profits and reinvest when the fund is at its low again. However, you should never time the market, because nobody can predict the market. Growing with the market works the best. It’s lucky to buy back the fund in the dive, but in most cases, you would probably miss the growth.

U.S. capital gain tax rates differ a lot for long term and short term investments. Funds that are held for more than one year is deemed long term and has a much lower capital gain tax rate. The ways to sell out mutual funds vary based on the purpose. There are mainly five ways:

- FIFO(First in first out)

- LIFO(Last in first out)

- Average Costing

- HIFO(Highest in first out)

- LIFO(Lowest in first out)

Let’s say the investor has 100 shares of the fund. It order to pay less capital gain tax, the investor can choose HIFO (Highest in first out) so that the profit is less and corresponding tax is also less; FIFO (First in first out) may also work fine since long term capital gain tax is much lower and can even be none. When you sell at average costing, oldest shares got sold first. Chinese funds selling is much easier. Selling fee also relates with how long the fund has been held. But the fee difference is way smaller. For instance, holding it for less than 7 days has a 1.5% fee while 365-day selling fee is 0.50%.

Capital Allocation

Investors are of different ages, economic backgrounds and risk tolerance. Accordingly, their capital allocation should be different as well. Lots of us know about compound interest. It’s definitely advantageous to have time on your side. If you start with 10K, and continue to put in 1K per month for the next 30 years, your total asset then will be about 2.15 million giving a 10% APY. It feels nice becoming rich slowly. If you are young and willing to take more risks, you can venture for 90% stocks and 10% bonds allocation; if you are middle-aged, you can make it 70% stocks and 30% bonds; if you are near retirement, you might want to be more conservative. 70% fixed-return-rate funds and bonds combined with 30% stocks might be a better option. It is a good idea to rebalance your portfolio every several years. However old you are, the money to invest should always be non-emergency fund. Put aside one year worth of living expenses given you lose your job, and invest the rest. Elsewise, it can work disadvantageously.