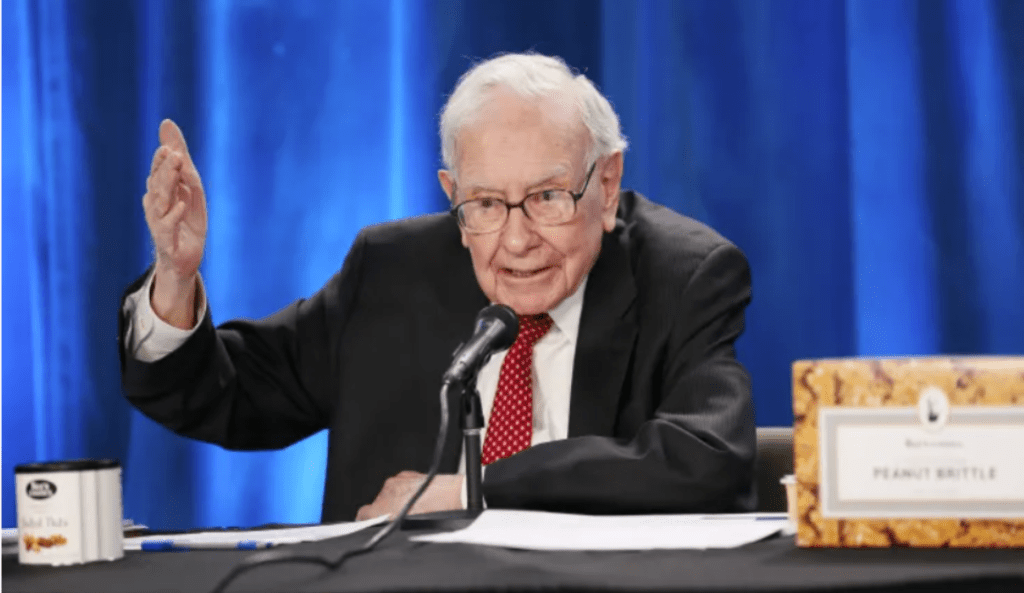

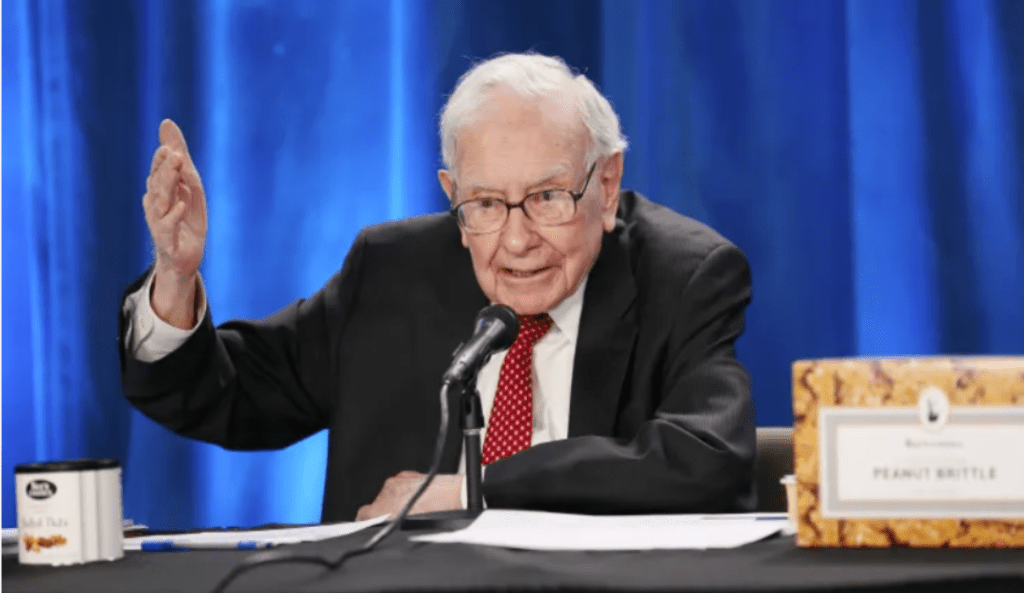

美联储上周首次加息25个基点,并建议今年再加息六次以应对不断上升的通货膨胀。在这样的大环境下,如何保持我们的购买力和资产价值,最好的办法就是看投资大师在历史上严重的通货膨胀时期是如何投资的。以下是沃伦·巴菲特历年来有关通货膨胀问题的回答,我们应该可以从中得到一些启示, 较清楚地知道该如何投资配置。

问:今天上午早些时候,您讨论了已经侵蚀并可能继续侵蚀美元的政策。在您之前给股东的一些信中,也警告过通货膨胀的危险,并告诫股东在全面评估企业业绩时应充分考虑通货膨胀的影响。您预计美元大幅贬值会在多大程度上引发通胀,从而对伯克希尔的持股及其业务产生不利影响?在美元疲软的背景下,应该多大程度地调整伯克希尔的整体表现?(2005年伯克希尔·哈撒韦股东年度大会)

巴菲特:我们认为总的来说,我们的企业在通胀环境下会做得很好。但是通货膨胀会破坏价值,而且(对不同企业)破坏并不相同。

在通货膨胀期间最好的生意是保持其美元实际价值的盈利能力,而无需进行相应投资来为通货膨胀导致的名义上的增长提供资金。最糟糕的生意是你必须往糟糕的业务中不断地投入更多的资金。

实际上,航空公司在过去40年中一直受到通货膨胀的影响,因为与30或40年前相比,他们现在不得不投入大量资金到糟糕的业务上,那就是购买飞机。他们必须留在游戏里,不得不继续购买新飞机。而新飞机现在的成本要高得多,而且回报仍然不够。

所以最好的保护是一个不需要投入大量资金的非常好的业务。而且是最好的投资。如果你是镇上领先的脑外科医生或律师或者不管什么,你不必投入大量资金重新教育自己。当你去上医学院或法学院时,你用过去的美元价格买了你的专业知识,不必重新投资,并且你保持了目前美元的赚钱能力。

我们,查理和我一直怀疑通胀会恢复几十年前的势头。我们总认为通胀处在一种暂缓状态。我们认为关于通货紧缩的讨论完全是无稽之谈。当然,你认为贸易是会加剧可能出现的通胀趋势。我的意思是,显然,以欧元计价的油价上涨幅度远低于以美元计价的油价上涨幅度。你和我用美元购买汽油,由于美元贬值,比起住在欧洲或其他国家或澳大利亚,我们会看到我们的燃料成本增加更多。

因此,通货膨胀始终是我们考虑要购买哪种投资和生意类型的一个因素。但它并不和所有其他因素冲突。我的意思是,通货膨胀一直在。我们一直有考虑它。

喜诗糖果在通货膨胀时期表现很好,因为它没有必须以当前美元价格进行的巨额资本投资。你知道,如果我们是其他生意,例如公用事业生意,以美元计算,现在维持资本开销的成本要比30年前高得多。因此,你必须不断将越来越多的资金投入公共事业。你最好希望回报率在高通胀时期是相称的,就像在低通胀时期回报率会低一些。

查理?

查理:到目前为止,导致美元相对于其他货币贬值的事实一直在抑制美国的通货膨胀。换句话说,是其他人的竞争性出口优势迄今为止抑制了我们的通货膨胀。所以就是这样。

巴菲特:是的,你买鞋花的钱更少了。你知道,我们一部分鞋子生意被淘汰了。30年前,我们穿过的超过10亿双鞋中,有非常高的比例是在美国制造的。而现在几乎没有。如果它们都是在美国制造的,你买鞋子就要花更多的钱。毫无疑问。

问:鉴于我们正在应对印度非常高的通货膨胀,您对投资的人有什么建议?他们应该改变什么,应该做些什么?(2011年Shereen Bhan对沃伦巴菲特的采访,Forbes版权)

巴菲特:通货膨胀,凯恩斯(约翰·梅纳德·凯恩斯)多年前就说过,是一种无形的税,只有百万分之一的人才明白,这是对相信政府发行的货币的人征收的税。最好的保护,最好的抗通胀投资是提高你的赚钱能力,自己的才华。很少有人能最大限度地发挥他们的才能。如果你增加你的才能,他们就不能对它征税,他们不能把它从你身上拿走。因此,如果你在你的行业你的职业里变得更有用,医生也好,律师也好,无论什么职业,这都是对可能快速贬值的货币的最佳保护。而最好的投资,被动投资我认为是一门好生意。如果你拥有一家好企业的股权,那么无论货币发生什么情况,你都很可能保持购买力。但这很有趣。在美国,从我出生以来,一美元的价值已经下降了94%至6美分。所以通货膨胀对相信美元价值固定的人来说是一种非常残酷的税。但即使在通货膨胀时期,事情最终也会顺利。我的意思是,如果有人在我出生的时候就告诉我,一美元钞票会变成6美分。我可能会说,让我回去,我对进入那种世界不感兴趣。但实际上发展得也挺顺利,所以我没有什么抱怨。

问:在高通胀时期,伯克希尔哈撒韦旗下的哪些特定业务表现最好,哪些表现最差,为什么?(2015年伯克希尔·哈撒韦股东年度大会)

巴菲特:嗯,表现最好的企业是那些需要很少资本投资来促进通胀增长的企业,以及拥有强大地位可以随着通货膨胀提高价格的生意。你知道我们有个糖果生意,比如,自从我们购买了糖果业务以来,美元的价值可能至少下跌了85%,80%到85%。糖果店比起我们买下它的时候多卖了75%的糖果。但它有了10倍的收入,而且不需要更多的资金。因此,这种企业,以及任何有足够的定价自由度来抵消通货膨胀并且不需要巨额投资来支持的企业都会做得很好。像我们公用事业这样的生意,实际上可以获得类似债券的回报,债券收益率可能会大幅上升,从而导致高通胀。但你知道,如果你要建造一个每千瓦时容量成本两倍的发电厂,而得到的只是固定回报,它在通胀时期不会表现得那么好,因为它具有债券投资某些方面的特征,而债券通常不会在通胀中表现很好。查理?

查理: 但就像我们的保险业务一样,我们的资本密集型铁路生意无疑是世界上最好的铁路之一。我们的公用事业无疑是世界上最好的公用事业运营之一。因此,就这样也不错。主要业务都是世界一流水平。

巴菲特: 关于我们的铁路,政府谈到了在加利福尼亚建立高速铁路系统。他们讨论每条轨道长800英里。估计总成本约为430亿美元。估算的建造成本和类似成本会急剧上升,这种情况比减少哪怕一点点预算的情况来的多很多。当然,我们为一个有22000英里主轨道和6000多台机车以及13000座桥梁的铁路系统承担了430亿美元的债务,如果你想过买一座桥的话。所以通胀期间该资产的置换价值已经很高了,而且还会急剧增长。而世界和我们国家永远需要轨道交通。所以这是一个了不起的资产。这就留给政府去处理。

问:您是否看到通货膨胀开始增加的迹象?(2021年伯克希尔·哈撒韦股东年度大会)

巴菲特:我回答这个问题,格雷格可以补充。我们看到了非常严重的通货膨胀。这很有趣。我们也在提高价格。别人卖给我们的价格也提高了,我们也接受了。以房屋建筑为例。除了我们的预制房屋业务外,我们还有九家房屋建筑商,是国内最大的。所以我们真的有很多房地产生意。我们的成本在不断上升。钢铁成本每天都在上涨,这还没有完,因为工资上涨会随之而来。UAW签了一份为期三年的合同,我们得到了一份为期三年的合同,但如果你从通用汽车或其他地方购买钢材,你每天都要支付更多费用。所以这真的是一种经济,很火。我们没想到。

我们所有的公司,当他们认为允许继续各项业务时,我们关闭了家具店。我提过,他们平均关了六周左右,不知道重新开门营业时会发生什么。他们无法阻止大家买东西,我们也无法交付。他们说,“好吧,没关系,因为其他人也无法交付,我们等三个月或怎样。”所以未交付积压会增多。然后我们认为600美元付款结束时,大概是去年8月左右,就会结束了。但它一直在继续。我每周都会收到数据,我打电话去或他们打电话给我,每天回顾在芝加哥、堪萨斯城和达拉斯的三家不同商店发生的事。一直不停。人们口袋里有钱,他们会支付更高的价格。当地毯价格在一两个月内上涨时,他们宣布四月份的价格会上涨,我们的成本也在上涨。对大家来说供应链都已经搞砸了,但这几乎是一场购买狂潮,除了某些方面买不了。你确实买不了国际航空旅行。

因此,资金正从经济的一部分转移到其他部分。每个人的口袋里都有更多的现金,但与此同时,对一部分人来说,这是个糟糕的情况。这套西装,我实际上已经一年没穿西装了,这意味着干洗店要倒闭了。我的意思是,没人会带西装来干洗,也没人会带白衬衫。我老婆去的地方,小生意人,如果餐厅没有外卖和送货服务,就被淘汰了。另一方面,如果你有外卖设施,相同源头的销售,Dairy Queen上涨了很多但他们适应了。至少它现在不是一个价格敏感的经济体。我不知道一个生意在不同的价格指数中如何表现,但通货膨胀正在发生,比人们在六个月前或大约六个月前所预期的要多得多。

查理:是的。有个非常聪明的人认为这很危险,而且这仅仅是开始。

巴菲特:格雷格,你也适合发表评论。

格雷格:是的。沃伦,我想你已经提到了,当我们看到钢铁价格、木材价格、石油价格时,从根本上来说,这些原材料都面临压力。沃伦,我确实认为你已经触及了一些东西,它真的可以追溯到原材料。现在某些原材料的产品稀缺。这影响价格和交付最终产品的能力。我们企业在应对这一挑战,这种稀缺因素现在也还存在。这可能是我们之前讨论过的德克萨斯州的风暴造成的。当你在一个州拆除了许多该国其他地区非常依赖它的石化厂时,我们看到产生的影响在流动,无论是在价格上,还是在产品的整体稀缺性上,这显然是相辅相成的。但是挑战是有的,这是肯定的。

总结一下,通货膨胀时期,我们应该投资:

- 自己。增加自己的能力和竞争力,增加收入,保证购买力。

- 好的生意。好生意必须满足:

1)需要很少的资本投资来促进增长

2)拥有强大地位/护城河可以随着通胀提高价格

The federal reserve raised the interest rate by a quarter percentage point last week, and suggested six more interest rate hikes this year to tackle the rising inflation. In order to preserve our purchasing power and the value of our assets, the best way is to learn from investment gurus who have abundant experience investing during serious inflationary periods in history. Below are Warren Buffett’s answers to inflation related questions . Hopefully we have a better idea of what to do with our investment portfolio for a inflationary period.

Question: Earlier this morning, you discussed policies that have eroded, and that threaten to continue to erode, the U.S. dollar. In some of your earlier letters to shareholders, you warned about the dangers of inflation and cautioned that shareholders should fully take inflation into account when evaluating the performance of a business. To what degree do you expect a large decline in the value of the dollar to trigger inflation that would adversely impact Berkshire’s equity holdings and its businesses? And to what extent should we calibrate Berkshire’s overall performance against the backdrop of a weakening dollar? (Berkshire Hathaway 2005 Annual Shareholders Meeting)

Buffett: Well, we think, by and large, we have businesses that will do pretty well in inflation. But inflation destroys value, but it destroys it very unequally.

The best business to have during inflation is one that retains its earning power in real dollars without commensurate investment to, in effect, fund the inflation-produced nominal growth. The worst kind of business is where you have to keep putting more and more money into a lousy business.

In effect, the airlines have been hurt by inflation over the last 40 years, because now they have to put a whole lot of money in a lousy investment, which is a plane, compared to 30 or 40 years ago. And they have to stay in the game. They have to keep buying new planes. And the new planes cost far more now, and the returns continue to be inadequate.

So the best protection is a very good business that does not require big capital investment. And, you know, the best investment at all — of all — I mean, if you’re the leading brain surgeon in town or the leading lawyer in town or the — whatever it may be — you don’t have to keep re-educating yourself to be that in current terms. You bought your expertise when you went to medical school or law school in old dollars, and you don’t have to keep reinvesting. And you retain your earning power in current dollars.

We — Charlie and I are always suspicious that inflation will regain some of the momentum it had a couple of decades ago. We always think it’s in sort of remission.

We thought the talk about deflation was total nonsense. And certainly, the trade picture is one that you would think would accentuate any inflationary trends that might otherwise be experienced. I mean, obviously, the price of oil in euros has gone up far less than the price has gone up in dollars. And you and I are buying gasoline in dollars, so we have seen a bigger increase in our fuel costs because of the decline of the dollar than we would’ve seen if we lived in Europe, or some other — or Australia, for that matter.

So, it’s — inflation is always a factor in calculating the kind of investment, the kind of business, that we want to buy. But it doesn’t — it isn’t like it crowds out all other factors. I mean, it’s always been with us. We’ll think about it always.

See’s Candy has done fine during an inflationary period because it does not have huge capital investments that have to be made in current dollars. Other businesses we have, you know, if we’re — the public utility business, for example — it costs a lot more money to maintain capital expenditures now in dollar terms than it would’ve 30 years ago. So you have to keep putting more and more money into a public utility. And you’d better hope that the rate of return allowed is commensurate in times of high inflation the same way that it might have been in low inflation with a lower rate of return.

Charlie?

Charlie: Yeah. Well, so far, the facts that are driving the dollar down in relation to other currencies have been restraining inflation in the United States.

In other words, it’s the competitive export advantages of the other people that are — that have so far restrained inflation here. So, it’s —

Buffett: Yeah, you’re paying less for shoes. You know, we got killed in the — in parts of our shoe business.

And 30 years ago, of the billion-plus pairs of shoes used in the United States, a very high percentage were made here. And now, virtually none are. But if they were all being made here, you would be paying more for shoes. There’s no question about that.

Question: Given the fact that we are dealing with very high level of inflation in India, what would your advice be to people who are investing? What should they change, what should they do? (Forbes 2011 Interview on Warren Buffett by Shereen Bhan)

Buffett: Well inflation. Keynes (John Maynard Keynes) said many years ago that it’s an invisible tax that only one man in a million only understands that it’s a tax on people that had faith in their currency the governments issued. The best protection, the best investment against inflation is to improve your earning power. Your own talents. Very few people maximize their talents. And if you increase your talents, they cannot tax it while you are doing it. They cannot take it away from you. So if you become more useful in your activities, your profession, you know, doctor, lawyer, whatever it may be, that is the best protection against a currency that might decline at a rapid rate. And the best investment, passive investment I think is a good business. If you own an interest in a good business, you are very likely to maintain purchasing power no matter what happens in the currency. But it’s interesting. In the United States, what, the value of a dollar since I was born, has declined by 94% to 6 cents. So inflation is a very cruel tax on people who believe in fixed dollars. but things can work out pretty well even during inflationary time. I mean if somebody told me when I was born, you know that a dollar bill is gonna go to 6 cents. I might have said, you know, let me go back. I’m not interested in emerging into that kind of world. But actually it worked out pretty well, so I have no complaints.

Question: In a period of high inflation, which particular businesses owned by Berkshire Hathaway will perform the best, and which will perform the worst and why? (Berkshire Hathaway 2015 Annual Shareholders Meeting)

Buffett: Well, the businesses that will perform the best are the ones that require a little capital investment to facilitate inflationary growth, and that have strong positions that allow them to increase prices with inflation, and you know we have a candy business for example, The value of the dollar since we bought that candy business, is probably falling at least 85% I would say. 80 to 85% and that candy business sells 75% more pounds of candy than it did when we bought it. but it has 10 times the revenues, and it doesn’t take a lot more capital. So that kind of a business, any business that can, that has enough freedom to price to offset inflation and doesn’t require, commence to invest, a huge investment to support will do well. Businesses like our utilities, which get in effect, a bond-like return, but require, you know, if you are gonna build a generating plant that cost twice as much per kilowatt-hour of capacity. And all you gonna get is a fixed return, and yields on bonds go up perhaps dramatically they get high inflation. It’s not going to do that well in an inflationary period, just because it has certain aspects of a bond like investment and bonds generally are not going to do well in inflation. Charlie?

Charlie: Well, but like our insurance operations, our capital intensive railroad business is certainly one of the best railroads in the world. And Our utility operations are certainly one of the best utility operations in the world. And so it is not bad to be up there world class in your main businesses.

Buffett: Our railroad, the government’s talked about building a high speed rail system in California. I think they are talking about 800 miles a track. And their estimated cost was about 43 billion. And estimated cost on constructions and things like that go up dramatically, much more often than they get reduced even by a minor amount. And of course we paid 43 billion counting debt assumed for a rail system which has 22 thousand miles of main track and 6000 plus locomotives, and 13,000 bridges if you ever wanna buy a bridge. So that the replacement value of that asset during inflationary is already huge, and it would grow dramatically. And The world, our country will always need rail transportation. So it is a terrific asset. I’ll just leave it to them.

Question: Are you seeing signs of inflation beginning to increase? (Berkshire Hathaway 2021 Annual Shareholders Meeting)

Buffett: Let me answer that and Greg can give me. We’re seeing very substantial inflation. It’s very interesting. We’re raising prices. People are raising prices to us, and it’s being accepted. Take home building. We’ve got nine home builders in addition to our manufactured housing operation, which is the largest in the country. So we really do a lot of housing. The costs are just up, up, up. Steel costs, just every day they’re they’re going up. And there hasn’t yet been because the wage stuff follows. The UAW writes a three-year contract, we got a three-year contract, but if you’re buying steel at General motors or someplace, you’re paying more every day. So it’s an economy really, it’s red hot. And we weren’t expecting it.

All our companies, they thought when they were allowed to go back to work for various operations, we closed the furniture stores. I mentioned, they were closed for six weeks or so on average, and they didn’t know what was going to happen when they opened up. They can’t stop people from buying things and we can’t deliver them. And they said, “Well, that’s okay, because nobody else can deliver them either and we’ll wait for three months or something.” So the backlog grows. And then we thought it would end when the $600 payments ended, I think, around August of last year. It just kept going and it keeps going and it keeps going, and it keeps going. I get the figures every week, I call or calls me, and we go over day by day what happened at three different stores in Chicago and Kansas City and Dallas. And it just won’t stop. People have money in their pocket and they pay the higher prices. When carpet prices go up in a month or two, they announced a price increase for April, our costs are going up. Supply chains all screwed up for all kinds of people, but it’s almost a buying frenzy, except certain areas you can’t buy it. You really can’t buy international air travel.

So the money is being diverted from a piece of the economy into the rest. And everybody’s got more cash in their pocket, except for meanwhile, it’s a terrible situation for a percentage of the people. This suit, I haven’t worn a suit for a year practically and that means that the dry cleaner just went out of business. I mean, nobody’s bringing in suits to get dry cleaned, and nobody’s bringing in white shirts. A place where my wife goes… The small business person, if you didn’t have takeout and delivery services for restaurants, you got killed. On the other hand, if you’ve got take out facilities, same source sales, Dairy Queen are up a whole lot and they adapted. But it is not a price sensitive economy right now in the least. And I don’t know exactly how one shows up in different price indices, but there’s more inflation going on, quite a bit more inflation going on that people would have anticipated just six months ago or thereabouts.

Charlie: Yeah. And there’s one very intelligent man who thinks it’s dangerous and that’s just the start.

Buffett: Greg, you probably are in a good position to comment.

Greg: Yeah. Warren, I think you touched on it, when we look at steel prices, timber prices, any petroleum input, fundamentally there’s pressure on those raw materials. I do think something you’ve touched on, Warren, and it goes really back to the raw materials. There’s a scarcity of product right now of certain raw materials. It’s impacting price and the ability to deliver the end product. But that scarcity factor is also real out there right now is as our businesses address that challenge. And it may be some of that’s contributed or arisen from the storm we previously discussed in Texas. When you take down that many petrochemical plants in one state that the rest of the country is very dependent upon it, we’re seeing it flow through, both on price, but overall in scarcity of product, which obviously go together. But there’s challenges, that’s for sure.

To sum up, in inflationary periods, we should invest in:

- Ourselves. Increase our talents and earning power.

- Good business. A good business meets below criteria:

1). Require a little capital investment to facilitate inflationary growth

2). Have strong positions that allow them to increase prices with inflation